CORPORATE TRANSPARENCY ACT IN ACTION | TALES FROM THE TRENCHES – PART 1

And so begins the inevitable experiential anecdotes in this, the first year of implementation of the Corporate Transparency Act (“CTA”). I wrote a general overview of this law on January 15, 2024. I fully expected to encounter noteworthy experiences and information as this year progresses, and so far, I have not been disappointed. I hope to continue to share our experiences, and invite you to do the same.

TALE #1: ARE WE A LARGE OPERATING COMPANY?

Before I posted my article, I got an email from a client asking me to confirm that his company would be exempt from the CTA based on the following:

For example, to take advantage of the “large operating company” exemption, an entity must (1) employ 20 full-time employees in the United States; (2) have an operating presence at a physical office in the United States and filed a federal income tax or information return in the United States demonstrating more than $5,000,000 in gross receipts or sales.

At first glance, based on what I knew about the company, I thought this was an easy yes. As any lawyer must do, I went to the actual law to confirm. Not surprisingly, I needed to ask some more questions. For purposes of the exemption, the CTA has its own guidance regarding whether an employee is a “full-time employee,” and even what is considered the “United States!” Generally, a full-time employee averages 30 hours per week, or 130 hours per month. The United States means “[t]he States of the United States, the District of Columbia, the Indian lands (as that term is defined in the Indian Gaming Regulatory Act), and the Territories and Insular Possessions of the United States.” In addition, “gross receipts” means “net of returns and allowances” and net of any such gross receipts or sales “from sources outside of the United States.” Once I clarified these points with the client, I was able to confirm his company should be exempt from the CTA.

TALE #2: THE PROCESS OF FILING THE BENEFICIAL OWNER INFORMATION (“BOI”) REPORT

I already have personal knowledge of an individual attempting to file the BOI report on his own. While it was mostly correct, he omitted an individual with “substantial control” that was not an owner. His experience was that one is not offered guidance in the process of completing the report; therefore, it is important that the client either receive competent advice or thoroughly review the informational materials provided by FinCEN and others prior to filing the report.

TALE #3: OBTAINING AND USING FinCEN IDENTIFIERS

As discussed in the original article, the CTA allows individuals who are either a beneficial owner or otherwise exercise substantial control over a reporting company, to obtain a FinCEN identifier, and provide that to reporting companies in lieu of their personally identifiable information (“PII”) required by the CTA. This allows the individual to submit their PII directly to FinCEN rather than the reporting company. I am not sure how much comfort that provides the individuals, but it is an opportunity to simplify the obligations of the applicable reporting company(ies), discussed further below.

Your humble author is the proud owner of her own FinCEN identifier. It was fairly easy to get one. You can get yours here: https://fincenid.fincen.gov/landing. An interesting and query-inducing side note: You will be required to log in using login.gov, which is a system maintained by the Federal government for use by the public and interaction with participating government agencies. I tried to create a new account, and was told I already have one, though I have no recollection of ever setting up such an account. I do, however, have an Id.me account that I set up some years ago. Id.me is a third-party service used by some government agencies for interaction with the public (including IRS which, like FinCEN, is also part of the U.S. Treasury). Perhaps there was some crossover there? Who knows?

Once I was able to log in, I was able to get the FinCEN identifier pretty easily, as I stated above. I took a picture of my driver’s license and submitted that. Now, if I move, I will have to file an updated report with FinCEN. However, any companies for which I am a beneficial owner or otherwise have “substantial control” will not have to file an updated BOI report when my information changes.

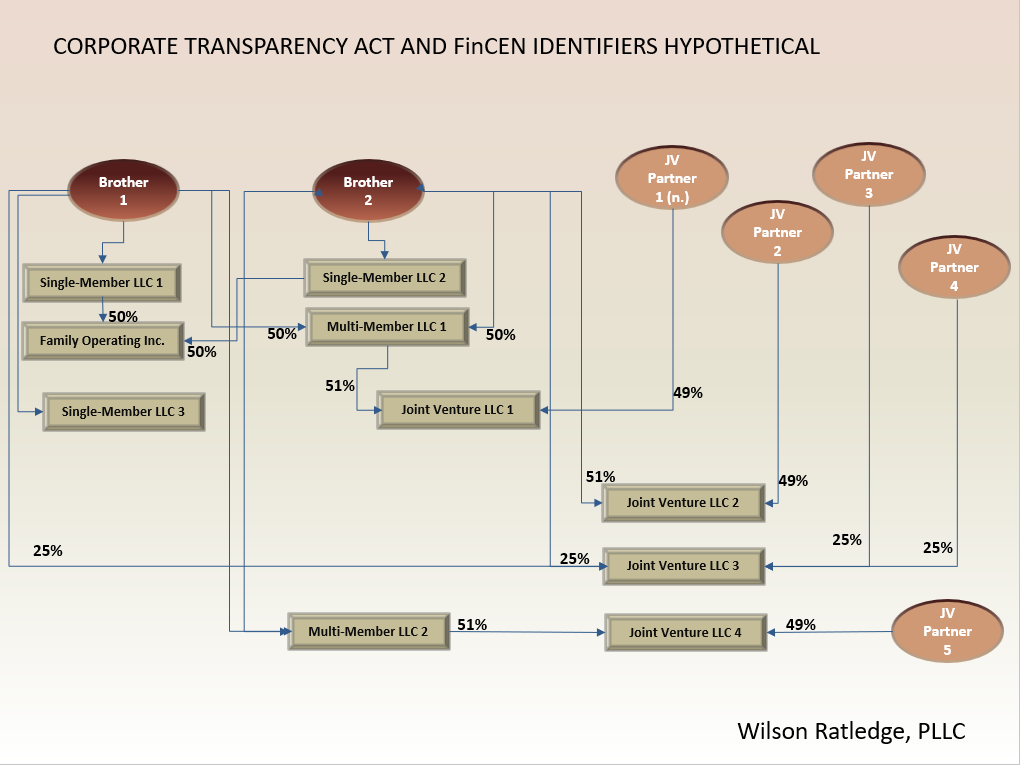

Please consider a hypothetical based on a real example in our office. Below is a chart (which has been abbreviated!) of companies in which our clients, two brothers, are involved as beneficial owners:

These clients are incredibly fortunate to have (and to have had for a long time) a brilliant and capable assistant that helps them and us keep all of this straight. Not all of our clients have that.

Imagine one person in charge of all of this, having to gather PII for all beneficial owners and others with substantial control as defined by the CTA. Then imagine what happens when one brother moves. In this hypothetical, one brother’s move would trigger TEN new BOI reports! As you may have figured out, as did their brilliant assistant, the brothers are obtaining their own FinCEN identifiers. We are also exploring the use of FinCEN identifiers for entities “upstream” of the reporting company.

I recommend, however, that this be taken a step further and that, in our hypothetical, all JV partners also obtain their own FinCEN identifiers. This should ease the burden of the reporting companies regarding providing FinCEN with any updates to the personal situations of its beneficial owners and other with substantial control.

I further contend that this strategy is appropriate for any entity with more than one beneficial owner or other individual with “substantial control.” One day I might contend it makes sense even for entities with only one applicable person. I do not think it would be detrimental in any material way to take that approach.

Again, stay tuned, I am sure there is more to come.